3 Components For Easier Reference

Do affordable houses still exist in Malaysia? What are affordable houses anyways? According to Khazanah Research Institute and Bank Negara Malaysia, the median price for the housing market is three times the gross annual household income, which means that the monthly payment for the house should not be more than 30% of the income or else it would be considered as an overburden for the consumer. Bank Negara suggests that an affordable home in Malaysia, based on the monthly median income of RM4,585 and the annual median income of RM55,020, is between RM165,000 and RM242,000. But with this fact, does it mean one has to wait till he or she reaches the targeted income just to get a home for themselves?

Let us share with you some components in getting yourself an affordable home.

Choice of Trustworthy Developers and Property Agencies.

It is crucial to understand that the range of property values varies based on project value, location, development cost, facilities factors as well as unit sizes. If you are seriously seeking for reputable and trustworthy developers to get your affordable homes at a reasonable rate, do some prior research and discuss with real estate professionals before making any buying decisions.

Utilizing Malaysia Housing Schemes

There are numerous benefits to being a first time home buyer in Malaysia. Bank Negara has an RM1 billion Fund for Affordable Homes to assist home buyers from the lower-income group to finance their purchases. The Fund extends to those with a monthly household income of RM4,360 buying their first home priced up to RM300,000. If this applies to you, you may contact participating financial institutions including AmBank, Bank Simpanan Nasional, CIMB Bank Berhad, Maybank and RHB Bank. Under the Joint Housing and Local Government Ministry (KPKT) and Real Estate and Housing Developers, there are also allocations based on state citizenships to be eligible for some affordable housing schemes like for Malaysians to benefit from. This effort is done to ensure the aim of having the “one family, one home” dream come true and making people’s lives safer and more comfortable. Check out the website to understand the eligibility and ways to apply for one.

Opting for Under Developing and New Projects

Oftentimes, new developers offer a very good deal for property booking when the project is first launched as it takes time for project completion. Once the project is completed, the property value often increases higher than the booking value. At this point, you get to decide to stay at the new property or even rent it out at a higher value while using the profit margin to cover up your own stay property value.

Affordable housing is a basic right of consumers. It is the government’s role to ensure that all Malaysian have access to affordable homes despite their income range. FOMCA suggests that the government invests more in financial education for all consumers, especially young workers, to create awareness and build knowledge and skills on prudent financial management and making informed decisions in the market, including purchasing major assets such as houses.

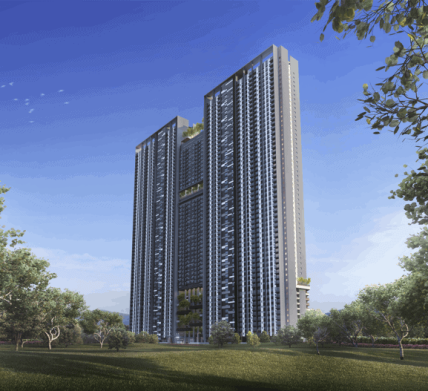

Visual By Mah Sing Group

Related Article: First Time Home Buyers, Equip Yourself with These 4 Tips in Getting the Best Deal!

Getting a brand new home in KL is EAZY TO OWN with ZERO down payment, ZERO uncertainties, ZERO payments during construction & ZERO worries with lower monthly payments. Please visit https://www.mahsing.com.my/eazy-to-own for more information and get your dream home now!

Citations:

https://www.nst.com.my/opinion/letters/2017/09/276244/what-affordable-housing

https://www.mahsing.com.my/blog/affordable-home-housing-malaysia/