Urban migration has been increasing rapidly since the 70s especially to the capital city of Kuala Lumpur. KL city is the primary commercial hub of Malaysia hence it offers more job and career opportunities. While many would say they are working or residing in Kuala Lumpur, do they really mean it?

It is always a hotly debated topic whether KL is still an ideal location to live in. Some people will rather get out of KL and reside in nearby towns within the Klang Valley. One of the common reasons for house buyers to skip KL is: “I could not find a decent new property in KL.” On the other hand, some would suggest opting for used properties instead of new ones.

We will dissect some of the common considerations and issues between a new and old property in KL.

1. Location

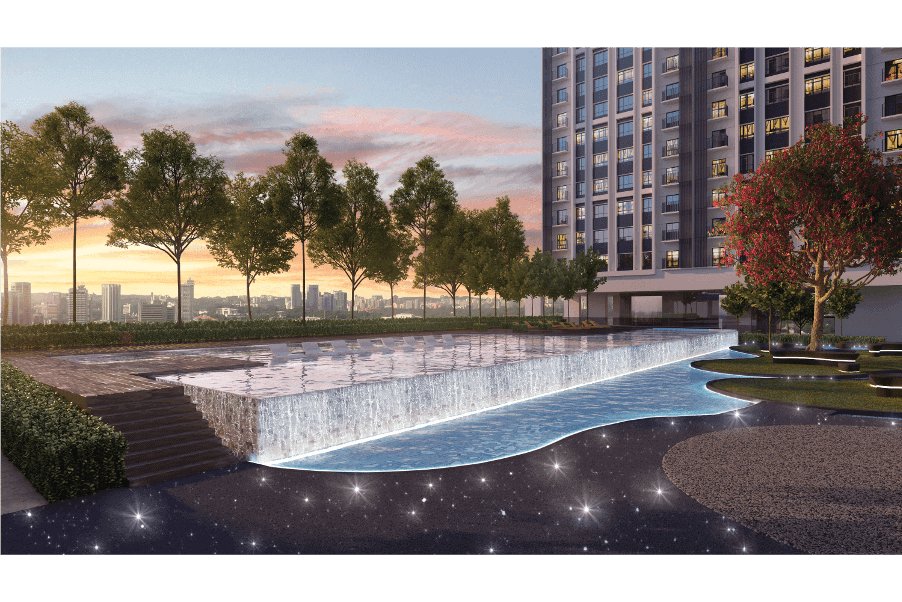

As expected, urbanization takes the toll out of land availability which is why properties at decent locations are not easy to obtain. In contrary, it is no mission impossible to find decently located new properties in KL. There are plenty of options available than what you might have thought. In reality, you may not be expecting walking distance to your workplace but there are a lot of ongoing new developments that could truly open up your eyes.

You should not limit yourself on finding old and used properties around KL only. Not to forget, new developments are very well planned that they are sort of future proof too. Some new locations would have better access to public transport such as the MRT and LRT. Major linkage to highway and trunk roads is also as important so that you will not need to make a complicated manoeuvre to reach your destination.

New developments around KL also offer you the opportunity to choose either a mixed development or residential only property. For those who prefer convenience, you can opt for mixed development property that also houses retail units.

Visual by Depositphotos: https://depositphotos.com/261348790/stock-photo-kuala-lumpur-skyline-night.html

2. Quality and Durability

Despite the saying that older properties tend to be built with better materials and workmanship, the authenticity of this statement could not be conclusively verified. Things were meant to be broken hence you might expect more issues in a used property than a new one. Don’t be fooled by grapevines or hearsays within the real estate industry. Some agents will claim new properties will be more inferior in quality than those which were built decades ago. Be sure to do your research on the building materials, or cross-checking some facts with the developers before you decide to buy.

Now comes to the durability part – if you plan on buying a few decades old properties, imagine the number of things you’ll need to fix and replace. Even if you decide to make it an investment unit, you will still have to make sure that everything is working fine before you can rent it out.

Things like plumbing and the sanitary system could be a nightmare if it is not tackled correctly. Refurbishing an old property doesn’t come cheap either if could be just as expensive as the purchase price of the unit alone if you plan to do a full renovation!

3. Entry Cost

This has to be the most critical part of acquiring a property. While old properties seem to be the easier way out due to them being readily available, with some already fully renovated and is ready to move-in condition. This will not be an issue if you are cash-rich and willing to pay for the old property.

For some house buyers, acquiring an old property will be a costlier choice. First of all, some used properties are always selling above the market value which will lead to lower loan value. In this case, higher down payment is required to acquire the property. There are also other types of costs such as SPA, stamp duty, legal fees and agent commission.

With that said, a new property’s entry cost can be cheaper and developers will often absorb some of the costs – the most popular one is a low down payment scheme, which is usually in the regions of thousands of ringgit. Besides that, there are warranties given to new properties (via defect liability period) and defects can be mended and fixed by the developer during the warranty period. For old properties, the new owners will have to bear all the repairing costs.

Related Article: Getting a New Condominium in Kuchai Lama. Is It Still Worth It?

Getting a brand new home in KL is EAZY TO OWN with ZERO down payment, ZERO uncertainties, ZERO payments during construction, & ZERO worries with lower monthly payments. Please visit https://www.mahsing.com.my/eazy-to-own for more information.

Citation:

https://www.newgeography.com/content/003395-the-evolving-urban-form-kuala-lumpur

https://www.nst.com.my/property/2019/10/534361/challenges-buying-old-houses

https://loanstreet.com.my/learning-centre/entry-costs-buying-property