An April 2019 Global Living report released by real estate firm CBRE noted that houses in Kuala Lumpur are among the cheapest compared to 34 other cities worldwide. The report listed Hong Kong and neighbouring Singapore with an average property price of RM5.1 million and RM3.6 million respectively, a stark contrast with the Malaysian capital average of just under half a million ringgit.

Other news sources report that the market has bottomed out with better sentiments returning since property market cooling initiatives have taken place alongside an increased effort to drive affordable housing by the government. There are considerably more reasons to look at new property in KL. Here are our Top 10:

Reason No. 1: Transactions have been decreasing but buying interest is picking up

A May 2019 report by JLL Property Services Sdn Bhd published on the Real Estate and Housing Developers’ Association Malaysia’s (REHDA) website noted that the volume and value of residential transactions in Malaysia experienced year-on-year decline since 2014 but have started picking back up in 2018. This shows the market has bottomed out and purchasing confidence is returning.

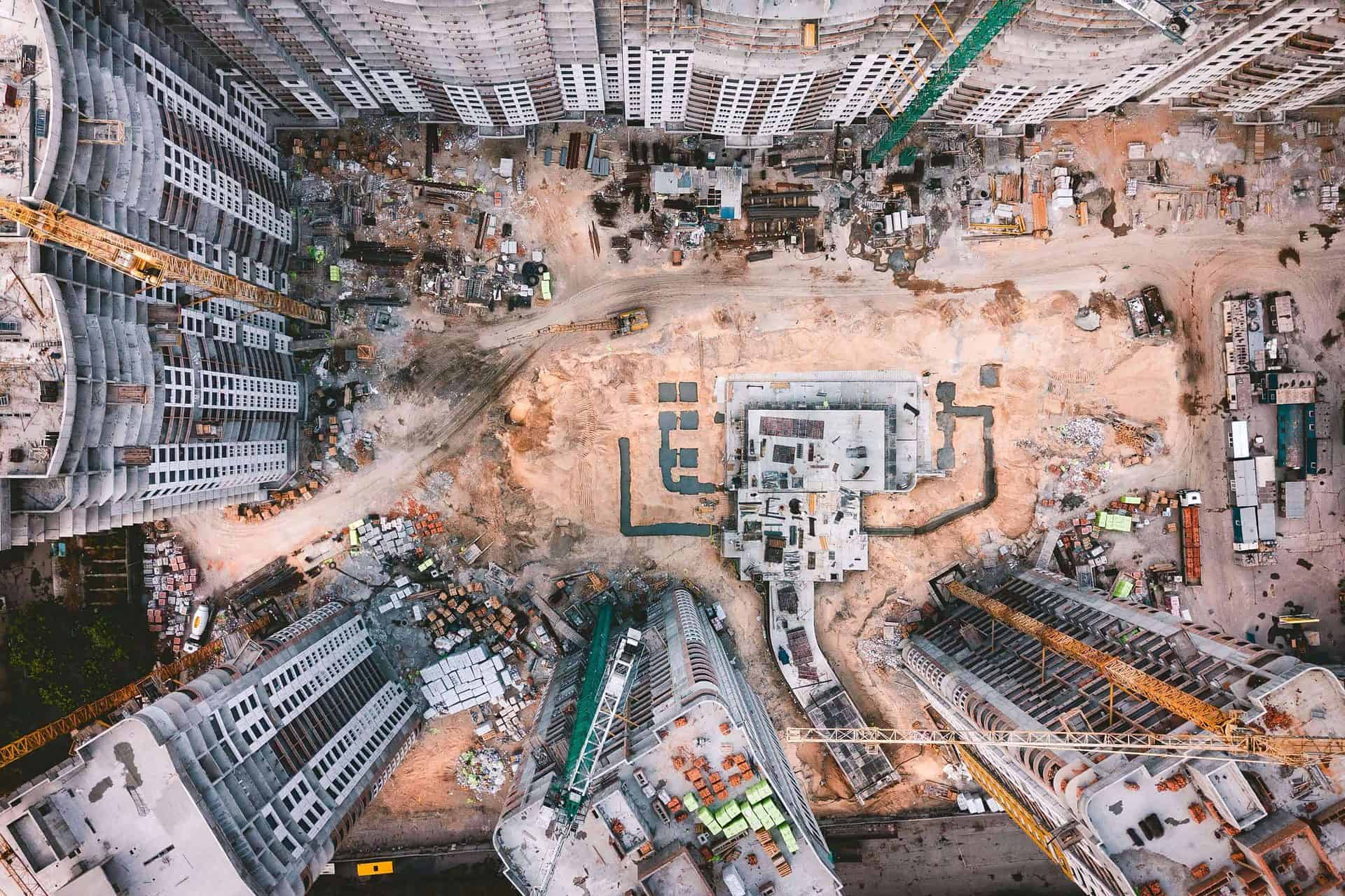

Reason No. 2: There are many units of KL Property available

A H1 2019 report released by the Valuation and Property Services Department and published on the National Property Information (NAPIC) website shows an existing stock of some 483 thousand units available in the market with about 14,000 additional new properties in the Kuala Lumpur market, so buyers are spoilt for choice.

Photo by chuttersnap

Reason No. 3: Smaller, sexier units are being built

Young urban dwellers may prefer to live in studio or one-bedroom apartments compared to bigger units so that they have more freedom and personal space. Likewise, developers are meeting that demand by building more boutique properties in Kuala Lumpur and its surrounds. The focus is to have swankier shared common spaces (like fitness and health facilities on the rooftop e.g. gyms, pools, meditation lounges, media rooms and multi-purpose halls). Home buyers pay less on their purchase with smaller square-footages.

Reason No. 4: Prices are increasing at a slower pace

The Malaysian House Price Index shows housing price growth is at its slowest since 2001, at 1.1% in Q3 2018 vs a peak of 14.3% in Q4 2012. This is a reflection of weaker demand for property in the higher-priced segments.

Reason No. 5: Government and builders are building more affordable housing

The Government, through the National Affordable Housing Policy or Dasar Perumahan Mampu Milik (DRMM) has pledged to drive more construction of properties within the affordable price range and developers have followed suit. The policy outlines detailed guidelines for developers keen on building affordable homes and includes building standards, key specifications and the ceiling price of affordable homes.

Photo by Ivan Bandura

Reason No. 6: More home-purchasing programs are available for new property in KL

Starting 1 September 2019, Bank Negara’s RM1 Billion Fund for Affordable Homes – to assist home buyers from the lower income group to finance the purchase of their first homes – have been enhanced to include an expanded eligibility criteria i.e. maximum monthly household income raised to RM4,360 and maximum property price up to RM300,000.

The Home Ownership Campaign has also been extended from 1 July 2019 to 31 December 2019. The campaign entails stamp duty exemptions on Memorandum of Transfer and loan agreements.

In the recent Budget 2020, more assistance have been announced to facilitate home-ownership such as the Rent-To-Own Scheme for first homes worth up to RM500,000 as well as an extension of the Youth Housing Scheme to enable eligible borrowers to obtain full financing and initial assistance on monthly instalments.

Reason No. 7: Liveable KL is getting larger

New property in KL can be found in the more recent, well-planned townships. There are excellent offerings in the KL South, KL North and central KL itself that are well-connected by upgraded expressways and public transportation services.

Photo by Izuddin Helmi Adnan

Reason No. 8: Residential loans applications are increasing

Comparisons of housing loan applications in H1 each year shows that they are back up on the rise in 2018 and 2019 at RM113 billion and RM126 billion respectively since dropping from RM112 billion in 2013; to RM109 billion in 2014; and RM101 billion in both 2015 and 2016 with approval rates still hovering between 40%-50%.

Reason No. 9: The Housing to Population Ratio remains high

The JLL (REHDA) report states that the number of property for sale in Kuala Lumpur outweighs the number of households in 2018. This means buyers can have their pick of the available KL properties for sale.

Citations:

http://napic.jpph.gov.my/portal

http://rehdainstitute.com/wp-content/uploads/2019/03/2.-Ms.-YY-Lau.pdf

https://www.edgeprop.my/content/1541687/national-affordable-housing-policy-or-dasar-perumahan-mampu-milik-drmm